Weekly Market Commentary – 3/12/2021

-Darren Leavitt, CFA

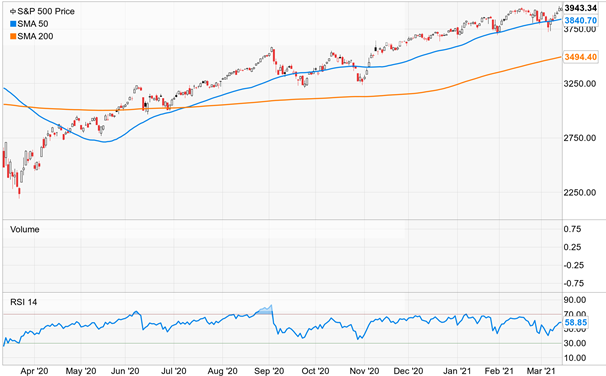

The S&P 500, Dow, and Russell 2000 equity indices made fresh all-time highs for the week while the NASDAQ rebounded from its sell-off over the last couple of weeks. President Biden signed the 1.9 trillion dollar stimulus bill and announced that vaccinations would be available to all adults by May 1st. Lockdown measures continued to be relaxed across the country as infection rates decline.

Optimism surrounding the re-opening of the global economy coupled with more fiscal stimulus pushed the 10-year bond yield to levels not seen since February of 2021. Additionally, the European Central Bank announced that it would increase their asset purchase program’s pace to help further stimulate their economies. US economic data for the week showed an increase in consumer sentiment, better than expected initial claims, and hints of some inflation at the producer level.

For the week, the S&P 500 gained 2.6%, the Dow increased 4.1%, the NASDAQ rose 3.1%, and the Russell 2000 outperformed with a 7.3% return. Cyclical sectors continued their outperformance while mega-cap growth stocks lagged, especially on Friday as interest rates spiked higher. The 2-year note yield fell one basis point to 0.14%, and the 10-year bond yield increased by nine basis points to close at 1.64%. The US Treasury auctioned 3, 10, and 30 year paper on the week, but the supply was met with decent demand. Gold prices inched higher by $21.10 to close at $1719.60 an Oz. Price action in oil was muted, with WTI prices falling $0.50 to close at $65.59 a barrel.

The information in this Market Commentary is for general informational and educational purposes only. Unless otherwise stated, all information and opinion contained in these materials were produced by Foundations Investment Advisers, LLC (“FIA”) and other publicly available sources believed to be accurate and reliable. No representations are made by FIA or its affiliates as to the informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. No party, including but not limited to, FIA and its affiliates, assumes liability for any loss or damage resulting from errors or omissions or reliance on or use of this material.

The views and opinions expressed are those of the authors do not necessarily reflect the official policy or position of FIA or its affiliates. Information presented is believed to be current, but may change at any time and without notice. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. You should consult with a professional advisor before implementing any strategies discussed. Content should not be viewed as an offer to buy or sell any of the securities mentioned or as legal or tax advice. You should always consult an attorney or tax professional regarding your specific legal or tax situation. Investment advisory services are offered through Foundations Investment Advisors, LLC, an SEC registered investment adviser.