Weekly Market Commentary – 6/30/2023

-Darren Leavitt, CFA

Markets ended the month of June in strong form. Better-than-expected economic data for the week showed a resilient economy and inflation moderating. Investors were dismissive of hawkish commentary from ECB President Lagarde and Fed Chairman Jerome Powell at the European Central Bank’s summit in Portugal. Fed Chairman Powell indicated that more than two rate hikes might be necessary to curtail inflation. The markets also dismissed what appeared to be a coup d ‘etat in Russia. The Bank of Japan and the People’s Bank of China intervened in the currency markets as their currency weakened. A hotter-than-expected CPI print in Japan made some think the BOJ may move away from its easy monetary policy while China continued to announce more stimulus measures.

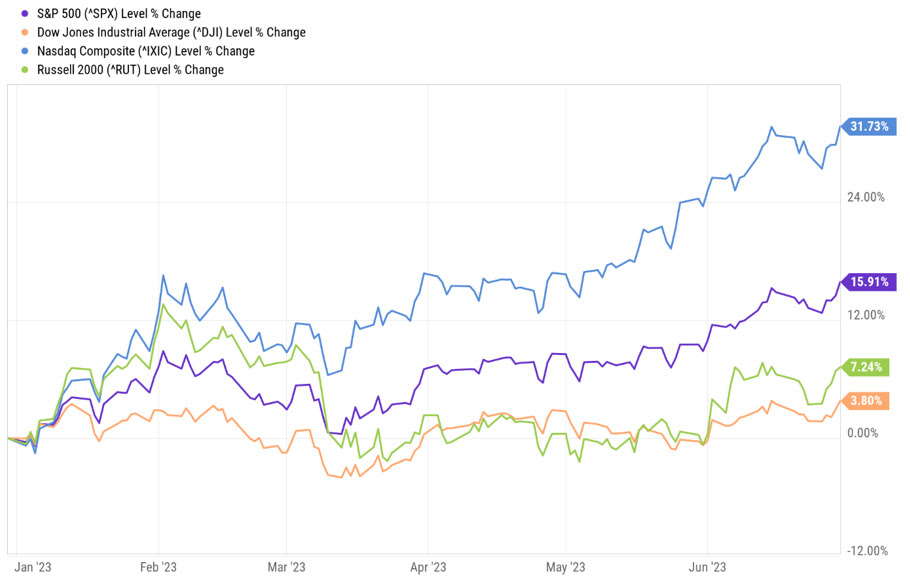

The S&P 500 gained 2.3% for the week, was up 6.34% in June, and ended the 2nd quarter up 15.9%. The Dow added 2% for the week, 4.4% for June, and is up 3.8% year to date. The NASDAQ increased by 2.2%, is up 6.46% for June, and has rallied 31.7% this year. The Russell 2000 inked a 3.7% advance, is up 6.76% in June, and has increased 7.2% this year. As the numbers indicate, the broader market in June participated alongside Mega-Caps. Apple eclipsed a 3 trillion dollar market capitalization on an upgrade from Citibank.

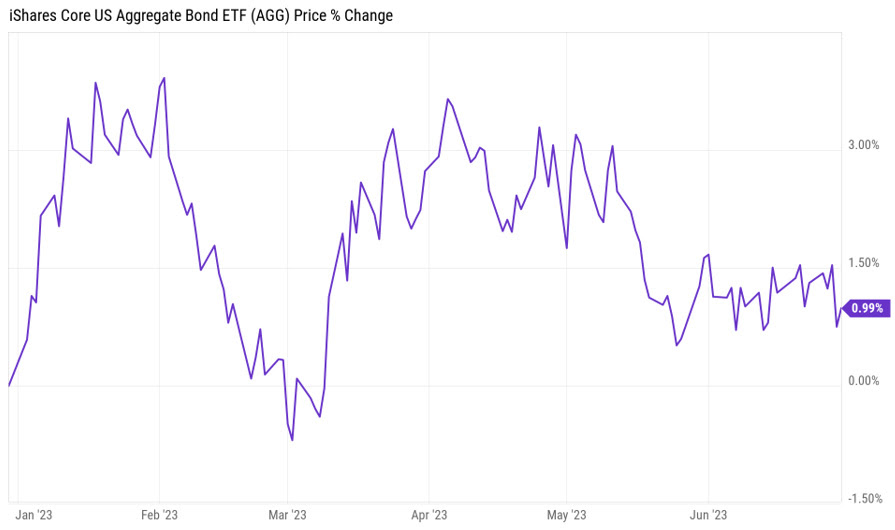

The US Treasury market struggled again this week, and June was a challenging month for bond investors. The 2-year yield increased by thirteen basis points for the week and was up forty-nine basis points in June to close at 4.88%. The 2-year yield has risen by eighty-two basis points this year. The 10-year yield increased eight basis points last week, is up eighteen in June, and up thirty-three this year. Bond prices fall as yields rise. The US Aggregate Bond Index is up 1% year to date.

Oil prices increased by 2.1% or $1.47, with WTI closing at $70.65 a barrel. The energy sector was one of the best-performing sectors this week but has been one of the worst this year. Gold prices were little changed, closing at $1928.90 an Oz. Gold tested the $1900 price level but was able to find support at that level. Copper prices fell by $0.04 to $3.76 Lb.

Economic data showed the third estimate of Q1 GDP revised to 2% from 1.3%. The PCE, the Fed’s preferred measure of inflation, increased by 0.1% on the headline number, which was slightly higher than the street consensus of a flat reading. Core PCE increased by 0.3%, in line with expectations. On a year-over-year basis, PCE increased by 3.8% in May, down from 4.3% in April, while Core CPI increased by 4.6% in May, down from 4.7% in April. Personal Income increased by 0.4% as Personal spending rose by 0.1%. New Home Sales continued to show strength in the housing market, rising by 763k units versus the estimated 680k. Consumer Confidence came in better than expected at 109.7 vs. 104. Initial claims ticked down to 239k, which was lower than the anticipated 268k. Continuing claims fell to 1742k from 1761k.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.