Weekly Market Commentary – 9/3/2021

-Darren Leavitt, CFA

Mega-cap technology issues pushed markets to another set of all-time highs in front of the Labor Day weekend holiday as traders rotated out of issues tied to the reflation trade. Ironically, growth issues outpaced value issues over concerns that economic growth is slowing and perhaps the realization that global economies will most likely face future growth inhibitors from other variants of Covid-19. Market news and action were tepid as traders took off early in front of the holiday. However, the economic calendar was heavy and focused on the August Employment Situation Report.

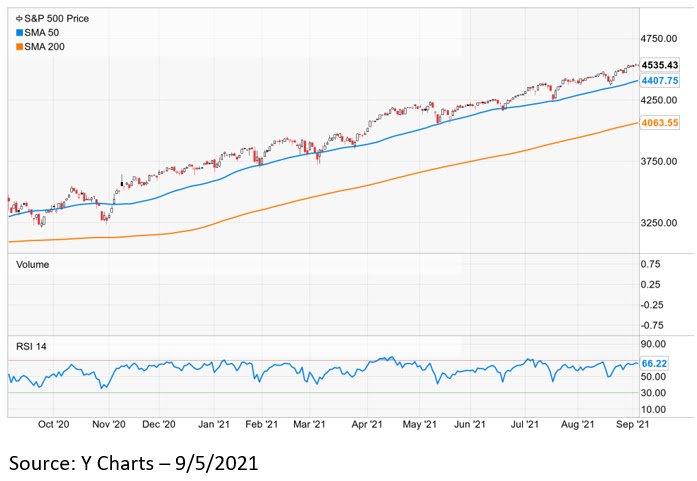

For the week, the S&P 500 added 0.6%, the Dow gave back 0.2%, the NASDAQ outperformed, gaining 1.5%, and the Russell 2000 inched higher by 0.7%. US Treasuries were also somewhat subdued. The 2-year note yield lost one basis point to close at 0.2%, while the 10-year yield fell gained two basis points to close at 1.32%. Oil prices increased by $0.48 to close at $69.05 a barrel on the back of what was a relatively muted OPEC meeting. Gold prices advanced $13.90 to close at 1833.70 an Oz.

Economic news took the spotlight this week, with investors focused on jobs. The August Employment situation report came in mixed, but the headline Non-farm payroll number missed the mark in a big way and added to the peak growth narrative in the market. Non-farm payrolls came in at 235K versus expectations of 800k. Private payrolls also missed the mark coming in at 243k versus 700k. The Unemployment rate fell to 5.2% from the prior reading of 5.4% but was in line with expectations. There was a nice tick-up in Average Hourly earnings that came in up 0.6%- the street had been looking for an increase of 0.3%. Consumer Confidence was also disappointing, coming in at 113.8 versus the street consensus of 123 and down from the July reading of 128.9. PMI data from China showed both Manufacturing and Services sector activity falling from prior readings and in Services contracting. ISM data in the US also showed activity falling, but both sectors remain in expansion mode.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.