Weekly Market Commentary – 6/11/2021

-Darren Leavitt, CFA

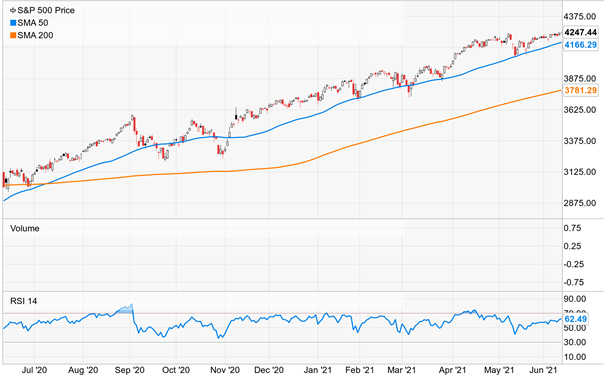

The S&P 500 hit all-time highs on the week in very tight market action. Cyclicals and US Treasury yields fell throughout the week on the notion that the economy has seen peak growth and peak inflation expectations. A strong CPI print and continued strong data on the labor market seemed to be dismissed by investors. Of note, a poll by Reuters that surveyed several economists found that most expect the Federal Reserve to announce its intention to begin tapering its bond purchasing program at the August or September meeting. Interestingly the week’s muted trade coincided with the VIX, a volatility measure, falling to 15.65, the lowest level since February of 2020.

The S&P 500 gained 0.4% for the week, the Dow lost 0.8%, the NASDAQ finished 1.8% higher, and the Russell 2000 rose by 2.2%. The US Treasury curve flattened. The 2-year note yield was unchanged at 0.15%, while the 10-year yield fell ten basis points to close at 1.46%. The 10-year touched 1.43 in the week, which is the lowest level seen in three months. Gold prices fell by $12.2 to close at $1879.40. Oil prices gained 2% or $1.52 to close at $71 a barrel.

A peak growth narrative was noticeable in how equity sectors traded for the week. Real Estate and Healthcare, along with Information Technology and Consumer Discretionary sectors, outperformed. On the other hand, Financials, Industrials, and Materials underperformed. It is worth mentioning that the Biotech sector was up 5.9% for the week partly on a controversial FDA decision to approve Biogen’s treatment for Alzheimer’s.

Economic news was headlined by the Consumer Price Index (CPI), which came in up 0.6% on a month over month basis, up 5% on a year over year basis, and an annualized rate of 5.8%. The core number, which excludes food and energy, was up 0.7% at an annualized rate of 4%. The preliminary June University of Michigan Index of Consumer Sentiment came in at 86.4 versus the estimate of 83.5 and better than the final may reading of 82.8. Inflation still appears to be a concern for the consumer. On the unemployment front, Initial Claims came in at 375k versus the estimate of 365k but were again trending in the right direction and the lowest level seen since before the pandemic hit. Continuing claims were down by 258k to 3.499 million.

The information in this Market Commentary is for general informational and educational purposes only. Unless otherwise stated, all information and opinion contained in these materials were produced by Foundations Investment Advisers, LLC (“FIA”) and other publicly available sources believed to be accurate and reliable. No representations are made by FIA or its affiliates as to the informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. No party, including but not limited to, FIA and its affiliates, assumes liability for any loss or damage resulting from errors or omissions or reliance on or use of this material.

The views and opinions expressed are those of the authors do not necessarily reflect the official policy or position of FIA or its affiliates. Information presented is believed to be current, but may change at any time and without notice. It should not be viewed as personalized investment advice. All expressions of opinion reflect the judgment of the authors on the date of publication and may change in response to market conditions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. You should consult with a professional advisor before implementing any strategies discussed. Content should not be viewed as an offer to buy or sell any of the securities mentioned or as legal or tax advice. You should always consult an attorney or tax professional regarding your specific legal or tax situation. Investment advisory services are offered through Foundations Investment Advisors, LLC, an SEC registered investment adviser.